The Hidden Cost of Underpaying Your CEO: What Capital-Efficient Series B Companies Get Wrong About Executive Compensation

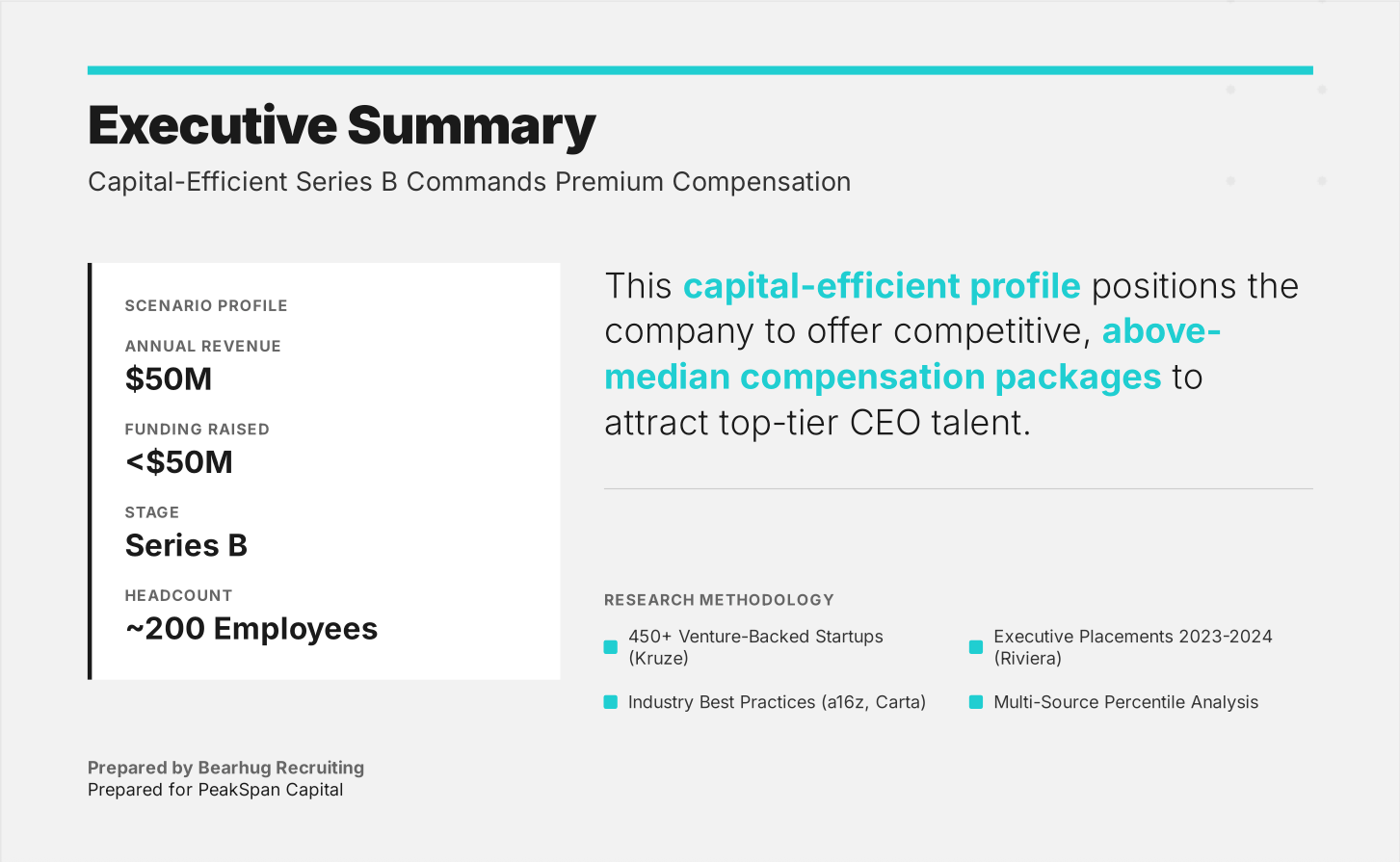

Today, I put together a CEO compensation benchmarking analysis for one of my favorite investment partners, PeakSpan Capital, focused on a very specific profile:

A capital-efficient Series B company with roughly $50M in revenue, ~$50M raised, and ~200 employees.

This is not a hypothetical scenario. It reflects a growing class of companies that are past early experimentation, operating with discipline, and now competing for a very narrow tier of senior leadership talent.

What surprised me was not how wide the compensation ranges were.

It was how often boards and founders mis-frame the decision entirely.

Below is a distilled view of what the data actually shows and how I believe Series B companies should think about CEO compensation if they want to win top-tier leadership without creating downstream problems.

1. Capital Efficiency Changes the Rules

A $50M revenue company that raised $50M is fundamentally different from a company that raised $50M to get to $10M.

Capital-efficient Series B companies are structurally positioned to pay above-median cash while maintaining discipline. That advantage is often underused.

Benchmarking across 450+ venture-backed startups, executive placement data, and multiple industry sources shows that this profile can responsibly target median to 75th percentile compensation to attract proven CEOs without sacrificing runway.

In short, efficiency earns leverage in the talent market.

2. Base Salary Is About Signal, Not Comfort

For hired CEOs at Series B, base salary ranges are wide.

Conservative positioning often sits around $225K–$250K.

Competitive positioning pushes $350K–$400K.

The mistake I see repeatedly is boards anchoring too low because of optics rather than strategy.

Base salary is not just pay. It is a signal.

It communicates seriousness, scope, and expectations to candidates who already have options. Under-positioning here often filters out the exact leaders companies claim they want.

The data suggests a practical market standard for this scenario sits closer to $275K–$325K when companies want credible access to top-tier operators.

3. Bonus Structures Are Optional but Powerful

Many Series B companies skip CEO bonuses entirely, especially pre-profitability.

That is not inherently wrong.

But when bonuses are used well, they create alignment without inflating fixed burn.

Typical target bonuses range from 25%–35% of base at the median, with upside reaching 50% at the 75th percentile. Best practice ties payouts to a small number of clear metrics such as revenue milestones, profitability thresholds, or product delivery.

4. Equity Is Where Most Debates Go Sideways

Founder and hired CEO equity are often conflated.

They should not be.

Founder CEOs retain large ownership stakes because they absorbed early risk. Hired CEOs require competitive cash and smaller, performance-linked equity grants to justify the move.

For Series B hired CEOs, median equity typically falls between 1.5%–2.5%, with aggressive packages stretching to 4% in highly competitive or specialized scenarios.

The mistake is not paying this equity.

The mistake is failing to align it with dilution reality, vesting mechanics, and the company’s next two stages of growth.

5. Geography and Sector Still Matter

Despite the normalization of remote work, compensation is not flat.

Bay Area CEOs still command roughly a 25% premium. New York sits around 20%. AI-focused leadership often adds another 20% premium on top of baseline SaaS benchmarks.

Ignoring these realities leads to stalled searches and credibility loss with candidates.

The Real Takeaway

CEO compensation is not about hitting a number.

It is about deciding what market you are actually competing in.

Capital-efficient Series B companies have more leverage than they think. When that leverage is used intentionally, it unlocks better leadership, faster execution, and fewer resets later.

When it is not, companies save dollars today and pay multiples tomorrow.

If you are a founder, board member, or investor navigating this decision, the question is not whether compensation feels high.

The question is whether it is correctly positioned for the leader you are trying to attract.

If you want to go deeper, the full analysis includes percentile benchmarks, bonus structures, equity frameworks, and implementation guidance pulled from multiple high-confidence data sources.