Founder Resources

Early & Growth Stage Startup Founder Recruiting Insights

-

![Kourosh Zamani Headshot]()

"Bearhug's in a category of its own. It's not even fair to compare them to other recruiters. Their process and work product blew me away."

Kourosh Zamani

-

![Maria Khokhlova Headshot]()

"Bearhug helped us hire damn great department heads who've all built out strong teams. We’re growing 10% MoM & have expanded to 30 states!"

Maria Khokhlova

-

![Himanshu Gupta Headshot]()

"Bearhug found our winning candidate within 7 days. Towards the end, it felt like they were our own Chief People Officer."

Himanshu Gupta

-

![Robert Romano Headshot]()

“Working with Bearhug was worth every penny and every minute. I now have a new standard for how I'll recruit for all future hires.”

Robert Romano

-

![Somya Kapoor Headshot]()

“I’ve recommended Bearhug to my board and will promote them to the other startup founders in my network. They've done an amazing job!"

Somya Kapoor

-

![Richard DeFrancisco Headshot]()

"Of the 55 Executive Search Firms I've worked with, none had the follow-up, professionalism, thoroughness & enthusiasm as Bearhug Recruiting."

Richard DeFrancisco

-

![Aaron Elder Headshot]()

“Bearhug's unwavering drive & persistence gave me the confidence they'd get the job done. We found an amazing "diamond in the rough!"

Aaron Elder

-

![Ryan Alshak Headshot]()

“Bearhug's a N of 1 at what they do. Any VC portfolio company with go-to-market hiring would be very lucky to work with them.”

Ryan Alshak

-

![Dmitry Korolev Headshot]()

"Now I really know what it means to be a "great recruiter". I'm afraid there is an impossible gap between Bearhug and the rest."

Dmitry Korolev

-

![Ivan Lvov Headshot]()

“Bearhug helped us hire all of our GTM function heads. Monthly sales have grown ~3x. Plus our team freaking loved working with them!”

Ivan Lvov

-

![Rohit Gupta Headshot]()

"Bearhug's hiring window was solid. The process was solid. Our needs were met effectively which is why I’ve come back for all our GTM roles."

Rohit Gupta

-

![Sriram Ramachandran Headshot]()

"Bearhug's approach was structured & methodical which helped us ferret out candidates we simply would not find through other means."

Sriram Ramachandran

-

![Josh Hailpern Headshot]()

"The experience with Bearhug was like a breath of fresh air. We hired a great new CEO and the way they serviced us was amazing.”

Josh Hailpern

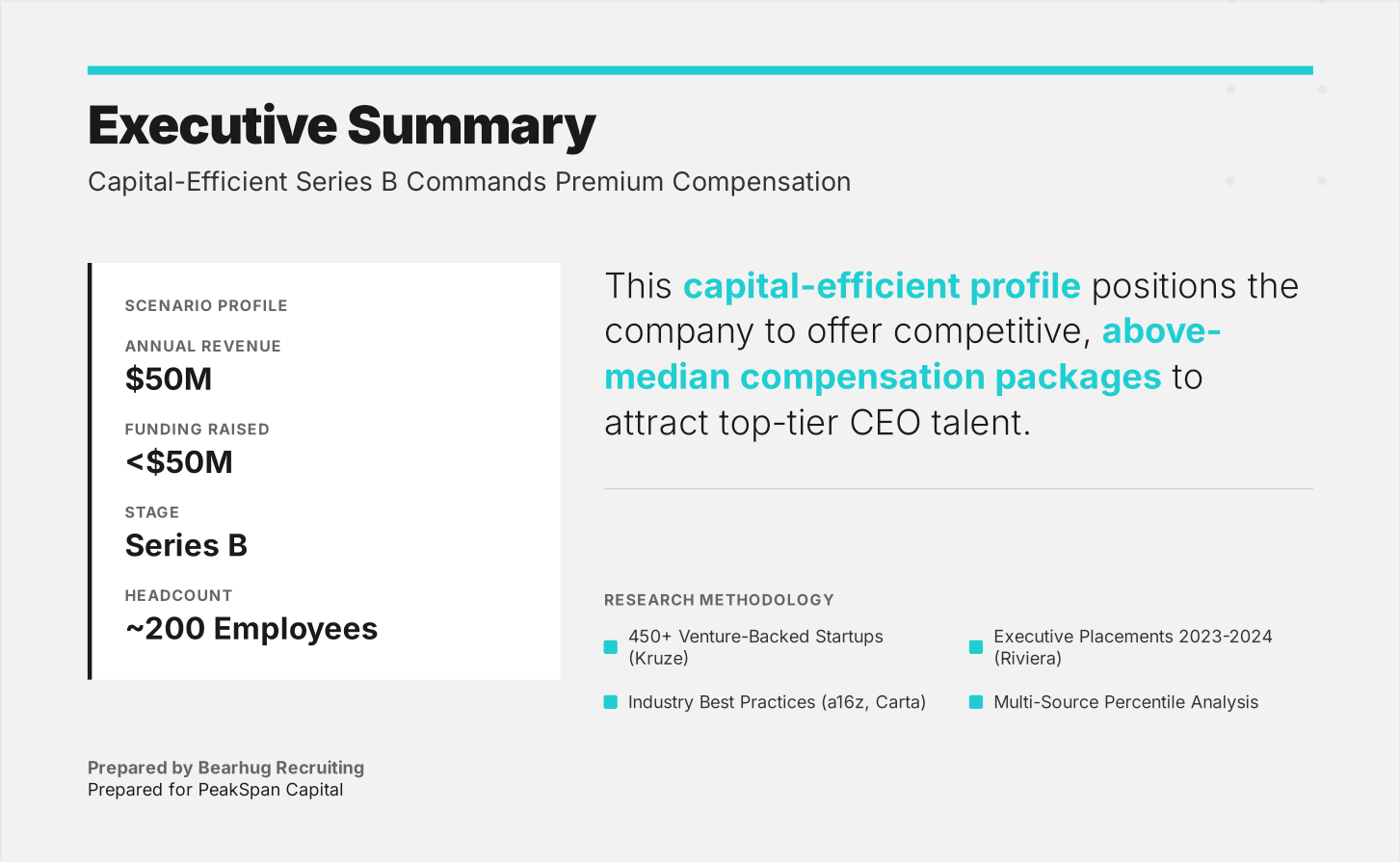

The Hidden Cost of Underpaying Your CEO: What Capital-Efficient Series B Companies Get Wrong About Executive Compensation

Series B CEO compensation is not broken. It is misaligned. After benchmarking CEO pay across Series B companies and pressure-testing it against real board dynamics and operator behavior, a clear pattern emerges. Many companies are anchoring CEO compensation to earlier-stage norms while expecting enterprise-grade execution. Capital efficiency has become a rationale for restraint, when in reality it should create leverage. By Series B, the CEO role shifts from survival to orchestration: building a senior team, managing complexity, and translating strategy into repeatable execution. Underpricing that role quietly filters out the leaders most capable of taking a company to $100M-plus. The signal is subtle but decisive. Top-tier operators disengage early. Executive hiring slows. Decision cycles stretch. Not because the business is weak, but because leadership leverage is capped. CEO compensation is not a cost decision. It is a positioning decision. When aligned correctly, everything downstream moves faster. When it is not, execution friction compounds at the exact moment speed matters most.

-

![Brett Moyer Headshot]()

"Your level is above 99% of recruiters because of the obsessive detail you go through to truly understand both the candidates and the role. Most firms say they go deep, but Bearhug actually does. That’s why we got the outcome we wanted, in the timeframe we needed."

Brett Moyer

-

![Brett Carlson Headshot]()

"Bearhug’s process was absolutely thorough. From market coverage to real-time visibility, nothing was left unexamined. We landed the perfect person for the moment. 10/10."

Brett Carlson

-

![Spencer Dusebout Headshot]()

"The Bearhug team is one of the top executive search firms in the nation. They have a very unique perspective on building and scaling companies and I highly recommend their work!"

Spencer Dusebout

-

![Phil Dur Headshot]()

“I want to commend the Bearhug team for being such excellent partners to our entrepreneurs and the larger PeakSpan team. We really appreciate and value our relationship with you!"

Phil Dur

-

![Anton Fedorov Headshot]()

“Bearhug helped one of our portfolio companies hire almost their entire US C-level team, that enabled the business to scale from 1 to 20M+ over the last 4 years. They are truly awesome.”

Anton Fedorov

-

![Jay Potter Headshot]()

"I’ve worked with dozens of search firms, and Kraig and the Bearhug team are truly something special. They put more thought into their work than almost anyone I’ve met in business."

Jay Potter

-

![Gaurav Manglik Headshot]()

“Kraig and the Bearhug team are one of the best startup recruiting firms I have ever met.”

Gaurav Manglik

-

![Vangelis Mihalopoulos Headshot]()

"Kraig, we are thrilled to formally finish the process. Congratulations on your helping us get an amazing new executive to our company!"

Vangelis Mihalopoulos

-

![Jon Kerry-Tyerman Headshot]()

"Having seen Bearhug from both sides, as a candidate & client, their approach is unmatched. Radical transparency and hands-on coaching delivered results that felt like a miracle."

Jon Kerry-Tyerman

-

![Amit Shrivastava Headshot]()

“Bearhug’s outreach stood out immediately — specific, contextual, and focused on real impact. The process was collaborative, transparent, and the most thoughtful I’ve ever experienced."

Amit Shrivastava

-

![Nick Ezzo Headshot]()

“Bearhug’s approach was refreshing — transparent, knowledgeable, and focused on adding value from the start. Their approach turned a high-stakes role into a smooth, confidence-building experience.”

Nick Ezzo

-

![Colin Parker Headshot]()

"Bearhug is the recruiting partner high-growth businesses need — experienced, transparent, and realistic about what’s possible in senior searches. They bring urgency and deep preparation to every step."

Colin Parker

-

![Doug Brown Headshot]()

"Bearhug does things differently. The process was thoughtful, transparent, and executed with a level of rigor and insight I didn’t expect."

Doug Brown

-

![Matt Fox Headshot]()

"I was initially skeptical, but Bearhug quickly proved different — down-to-earth, empathetic, and thorough. They exceeded all expectations and delivered a great outcome for both sides.”

Matt Fox

-

![Jason Murante]()

"Bearhug’s process was extremely structured, efficient, and effective. Unlike anything I’d ever experienced. The level of detail and organization gave me total confidence at every step."

Jason Murante

-

![Walter Rowland Headshot]()

"Getting to know the Bearhug team through such a thoughtful, structured process was a standout experience. Any high-growth startup needing specific executive hires should expect not just results, but a process that makes candidates want to join."

Walter Rowland